39 irs gift card scam

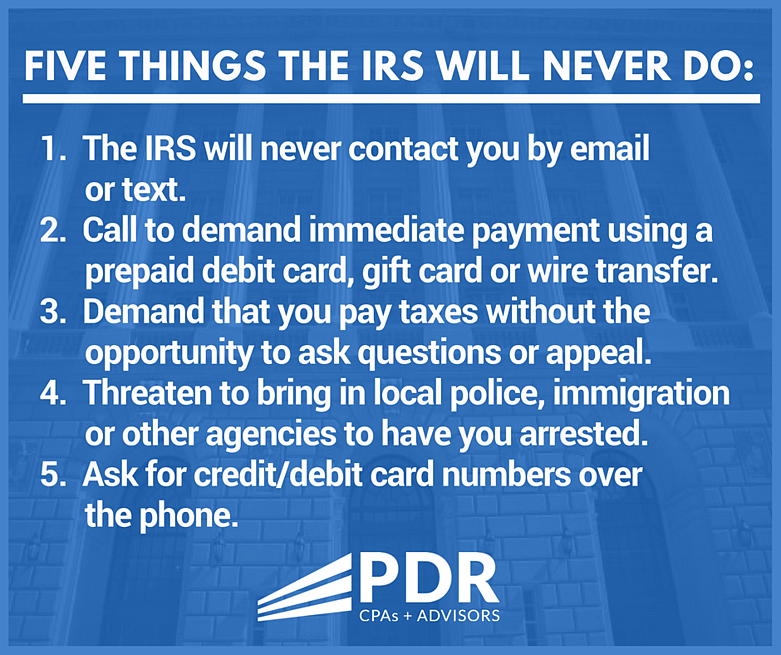

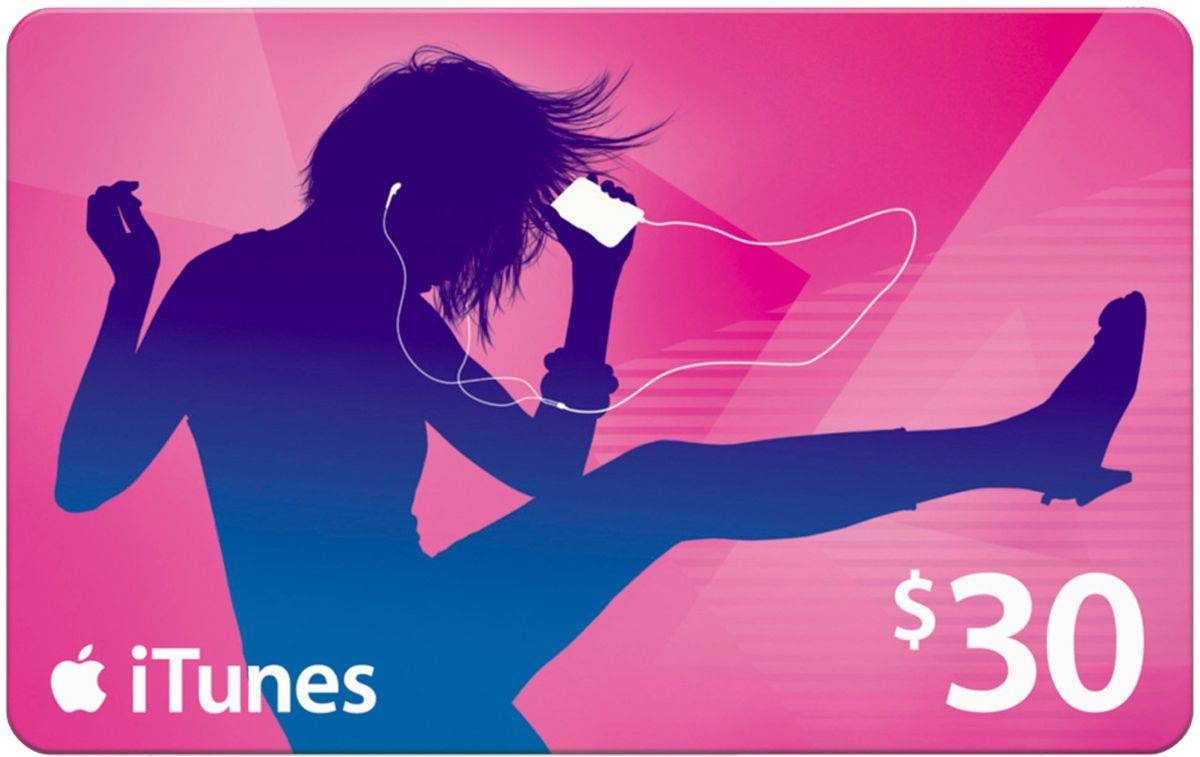

About Gift Card Scams - Official Apple Support If you have additional questions, or if you've been a victim of a scam involving Apple Gift Cards, App Store & iTunes Gift Cards or Apple Store Gift Cards, you can call Apple at 800-275-2273 (U.S.) and say "gift cards" when prompted, or contact Apple Support online. FTC: Scammers Increasingly Demand Payment by Gift Card. Scam Alert: IRS Warns of Scammers Asking for Gift Cards for Tax ... The IRS recently released a notice to warn taxpayers about the scam. Here's how it works: Someone will call a taxpayer and pose as the IRS, asking for gift cards from a variety of stores as payment for a past-due tax bill. They might also send an email or text message, or even reach out through social media.

Beware of Gift Card Scams | IRS Gift Card Scam | Utility Support Scam The IRS gift card scam. In this scam, a target receives a threatening message that's allegedly from the IRS and claiming they are at risk of arrest for tax evasion if they do not pay up immediately. However, they insist that payment can only be made in the form of a gift card.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/7290527/office.0.png)

Irs gift card scam

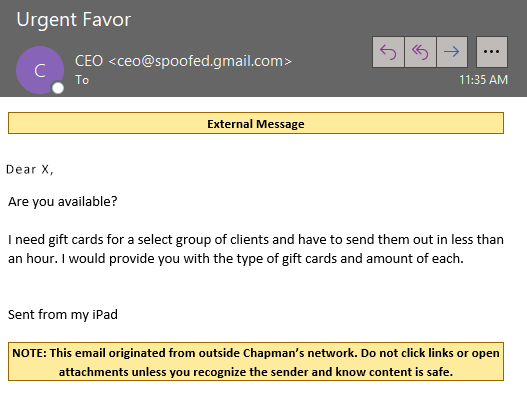

Is 'the IRS' asking you to pay by gift card? It's the latest 'impostor ... From January to September of this year, 54 percent of government-impostor scams involved the use of a gift card or reloadable payment card, according to the FTC. The next most common method of... Report Gift Cards Used in a Scam | Federal Trade Commission Anyone who tells you to pay with a gift card is a scammer, and once you've shared the gift card number and pin your money is probably gone. So what do you do? If you have paid with a gift card, contact the company that issued the card right away and then tell the FTC. Reporting to the company and the FTC helps us fight these scams. Gift Card Scam - YouTube video text script - IRS tax forms The scammer may call you impersonating an IRS agent, or contact you by text, email or social media. The criminal calls or leaves a voicemail with a callback number claiming that you are linked to criminal activity. The scammer will harass you demanding you pay a bogus tax penalty. The scammer instructs you to buy gift cards from various stores.

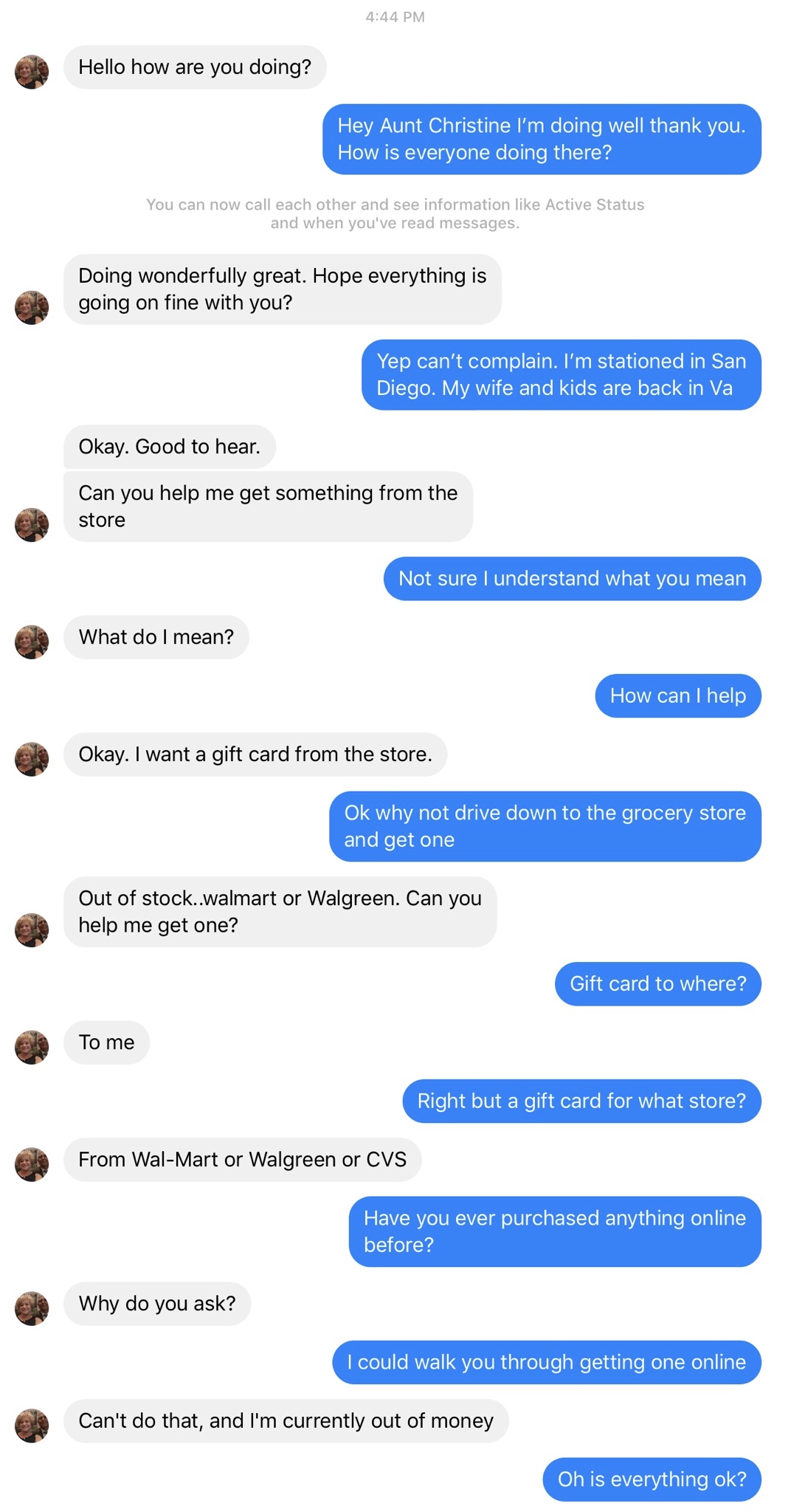

Irs gift card scam. IRS "Dirty Dozen" list warns people to watch out for tax-related scams ... These scams are often threatening in nature. While it has diminished some recently, the IRS impersonation scam remains a common scam. This is where a taxpayer receives a telephone call threatening jail time, deportation or revocation of a driver's license from someone claiming to be with the IRS. The Gift-Card Scam You Need to Watch Out for | Reader's Digest "The common theme with gift-card scams is a sense of urgency," says Mahnken. The caller will impersonate a government official—IRS, Social Security—with urgent news: you owe back taxes and ... Beware of Gift Card Scams - Harvester Financial Credit Union The IRS gift card scam. In this scam, a target receives a threatening message that's allegedly from the IRS and claiming they are at risk of arrest for tax evasion if they do not pay up immediately. However, they insist that payment can only be made in the form of a gift card. 4 Hilarious Scams That People Still Fall For - msn.com The basic premise of the scam is someone purporting to be from the Internal Revenue Service contacts you to let you know that you owe taxes to the IRS and it is going to be unpleasant if they have...

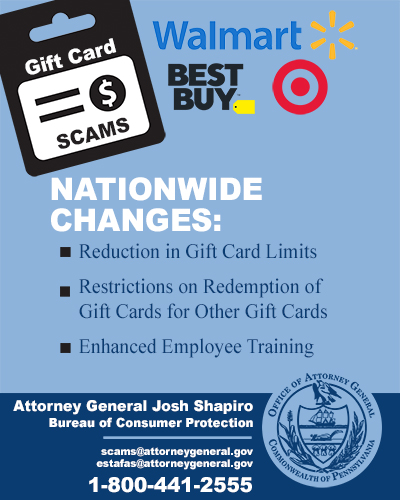

Taxpayers should watch out for gift card scam - IRS tax forms Contact the Treasury Inspector General for Tax Administration to report a phone scam. Use their IRS Impersonation Scam Reporting webpage. They can also call 800-366-4484. Report phone scams to the Federal Trade Commission. Use the FTC Complaint Assistant on FTC.gov. They should add " IRS Telephone Scam" in the notes. Gift Card Scams | Consumer Advice Here's a list of common gift card scams and schemes: The caller says they're from the government — maybe the IRS or the Social Security Administration. They say you have to pay taxes or a fine. It's a scam. Someone calls from tech support, maybe saying they're from Apple or Microsoft. Walmart saved millions from elder gift card scams - CNBC In 2021, gift cards were the most commonly reported method of payment for victims of imposter frauds who were more than 60 years old. Once the cards are purchased, scammers have their victims... Urgent IRS tax warning as scammers target you into costly gift card ... THE IRS has issued an urgent warning to be on the lookout for scammers who will try to trick you into gift card-buying schemes this holiday season. The agency urges that taxpayers be on the lookout for scams throughout the year but has said the schemes rise in prominence ahead of the holidays and before the tax season.

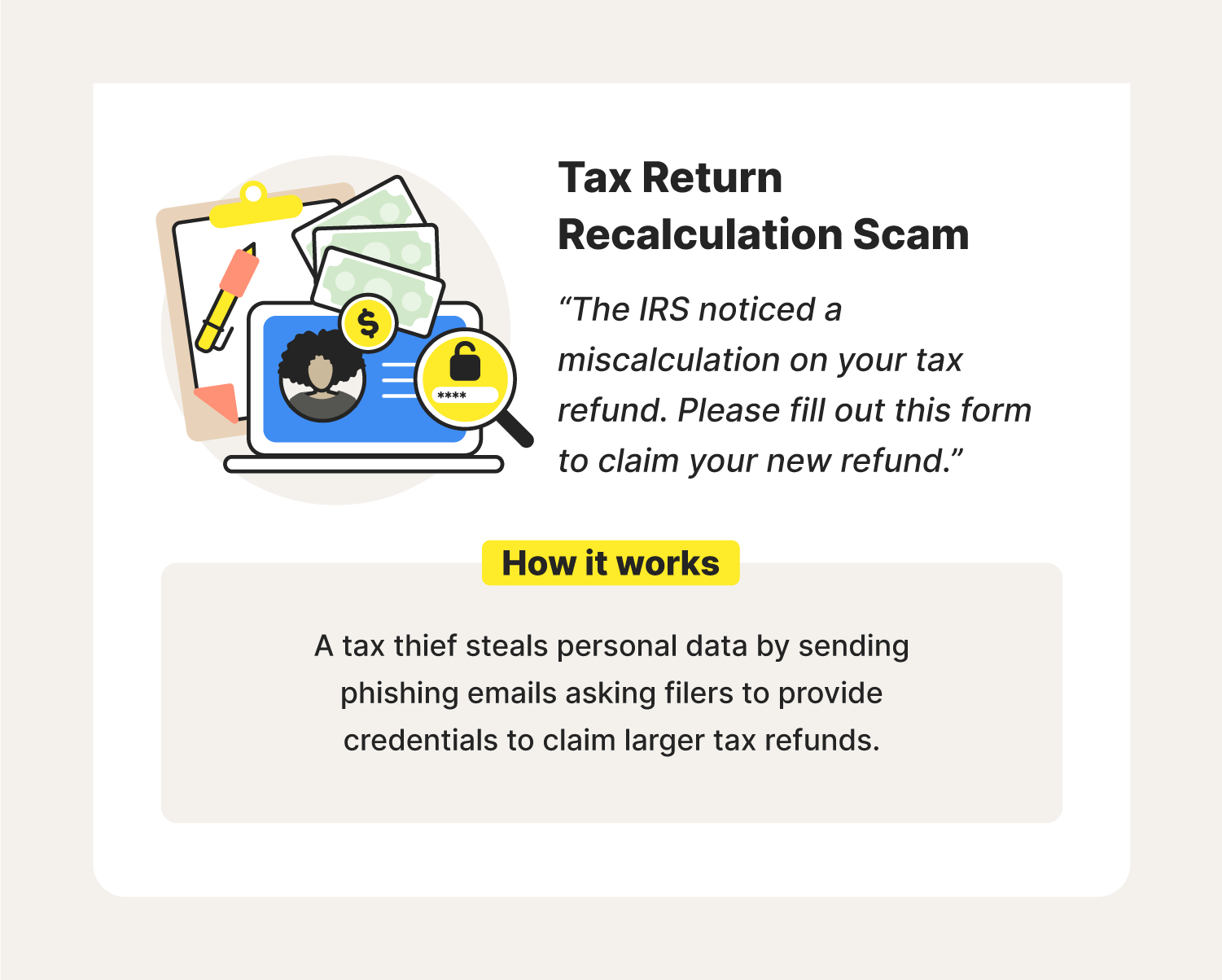

Warning about IRS phishing scams - The US Sun A scammer might "tell the taxpayer their identity has been stolen and used to open fake bank accounts," the IRS wrote, and tell the victim that they need to pay a fictitious tax penalty. After instructing the taxpayer to buy gift cards from stores or restaurants, the scammer asks the taxpayer for the card number and PIN. IRS Impersonation Scam Update - United States Secretary of the Treasury No legitimate United States Treasury or IRS official will demand that payments via Western Union, MoneyGram, bank wire transfers, or bank deposits be made into another person's account for any debt to the IRS or Treasury. Hang up on these fraudulent callers and go to the TIGTA scam reporting page to report the call. Watch our videos. April 21, 2016 IRS and Tax Identity Scams | USAGov The imposter may contact you by phone, email, postal mail, or even a text message. There are two common types of scams: Tax collection - You receive a phone call or letter, claiming that you owe taxes. They will demand that you pay the amount immediately, usually with a prepaid debit card or wire transfer. Tax Scams / Consumer Alerts | Internal Revenue Service - IRS tax forms These emails are a phishing scam, trying to trick victims into providing personal and financial information. Do not respond or click any link. If you receive this scam, forward it to phishing@irs.gov and note that it seems to be a scam phishing for your information.

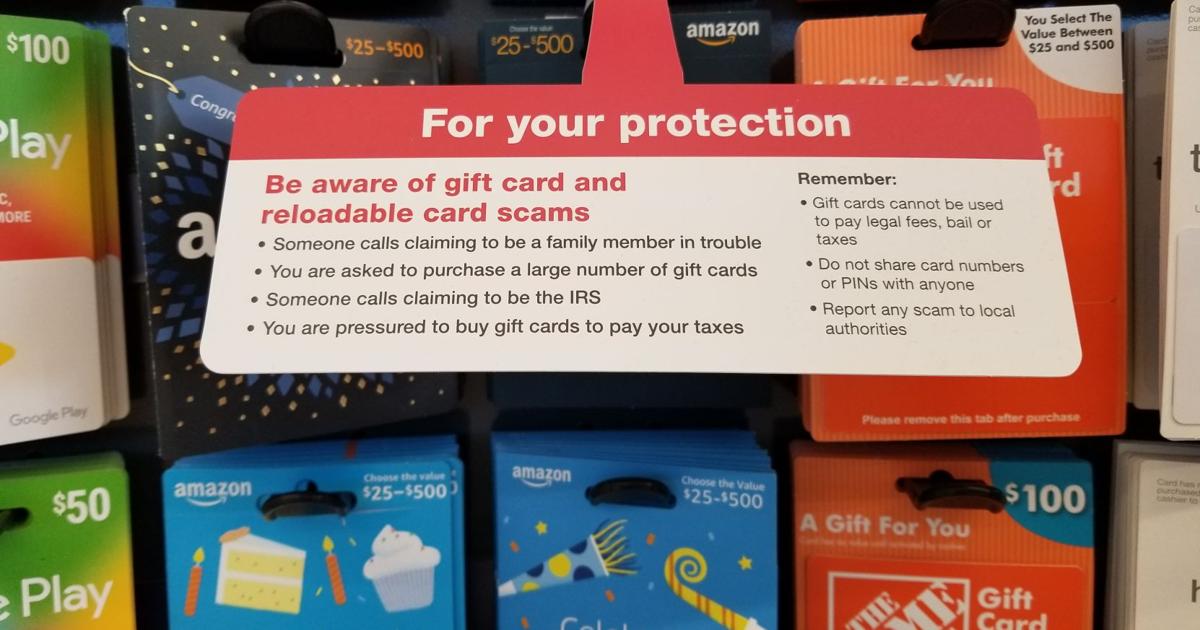

Protecting Yourself from Gift Card Scams - American Express Typically, scammers disguise themselves as a reputable company or family member and request payment in the form of gift cards. Important: Neither the Internal Revenue Service (IRS) nor any other government agency will ever request payment over the phone in the form of a gift card. These agencies have said so in their own warnings against scammers.

Gift Card Scams | Consumer Advice Consumer Alert Scammers are tricking more people into buying gift cards Cristina Miranda December 8, 2021 According to the newest Data Spotlight, 40,000 people reported losing a whopping $148 million in gift cards to scammers during the first nine months of 2021. Those are staggering numbers which have Consumer Alert Hot rental car market = scams

Holiday scam reminder: Gift cards are never used to make tax payments Use their IRS Impersonation Scam Reporting webpage. They can also call 800-366-4484. Report phone scams to the Federal Trade Commission. Use the FTC Complaint Assistant on FTC.gov. They should add " IRS phone scam" in the notes. Report threatening or harassing telephone calls claiming to be from the IRS to phishing@irs.gov.

IRS SCAMMER WANTS TARGET GIFT CARD - YouTube The scammers phone line was not that good but can be heard ok ****CHECK OUT THESE OTHER FINE CHANNELS**** Joe Scambait: ...

7 types of gift card scams: How to spot them and avoid them Scam 1: Threatened by the IRS In one of the more common gift card scams, a criminal will call you or send you a text or email message claiming to be working with the IRS. This scammer will say that you owe unpaid taxes and that the IRS will arrest you if you don't pay now. The criminal says that you must pay the taxes you owe with a gift card.

Gift Card Scam - YouTube video text script - IRS tax forms The scammer may call you impersonating an IRS agent, or contact you by text, email or social media. The criminal calls or leaves a voicemail with a callback number claiming that you are linked to criminal activity. The scammer will harass you demanding you pay a bogus tax penalty. The scammer instructs you to buy gift cards from various stores.

Report Gift Cards Used in a Scam | Federal Trade Commission Anyone who tells you to pay with a gift card is a scammer, and once you've shared the gift card number and pin your money is probably gone. So what do you do? If you have paid with a gift card, contact the company that issued the card right away and then tell the FTC. Reporting to the company and the FTC helps us fight these scams.

Is 'the IRS' asking you to pay by gift card? It's the latest 'impostor ... From January to September of this year, 54 percent of government-impostor scams involved the use of a gift card or reloadable payment card, according to the FTC. The next most common method of...

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ZE6JI5RW5A63MXEE63KOAQ4RE.png)

0 Response to "39 irs gift card scam"

Post a Comment